Private Retirement Scheme Malaysia

A voluntary long term contribution scheme designed to help individuals accumulate savings for retirement.

Private retirement scheme malaysia. Complements the mandatory contributions made to epf. Funds under prs are neither capital guaranteed nor capital protected. Up to rm3 000 tax relief per year. Facebook tweet pin email shares 2.

Like with epf prs contributions are also divided 70 30 into two sub accounts. The guidelines on private retirement schemes guidelines are issued by the sc pursuant to section 377 of the capital markets and services act 2007 cmsa. October 30 2019 mar desmond investing private retirement scheme prs one comment. Prs is similar to the employees provident fund epf in that it is a retirement scheme.

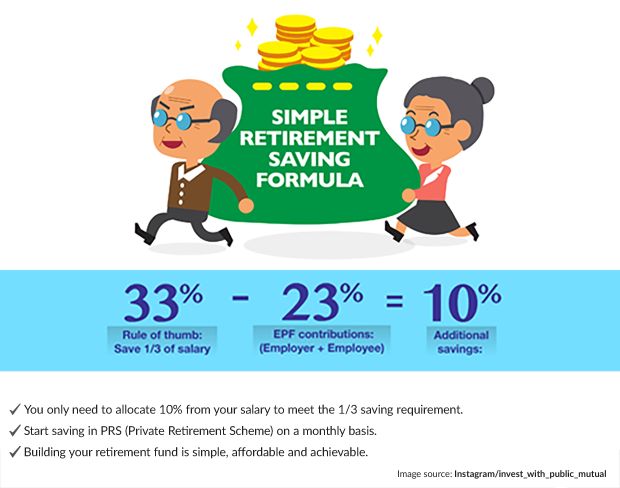

Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement. Find out more about prs here. Prs is a voluntary long term investment scheme designed to help individuals accumulate savings for retirement. The mechanism of private retirement scheme malaysia as the name implies prs is privately managed by asset management companies also known as prs providers.

Previously i have shared with you the key reasons to invest in prs malaysia. In 2011 securities commission malaysia sc issued a regulatory framework to govern the industry. Each prs offers a choice of retirement funds from which individuals may choose to invest in based on their own retirement needs goals and risk appetite. Sub account a and sub account b.

The contents in this website were prepared in good faith and the private pension administrator malaysia ppa expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion. These guidelines set out requirements that must be complied with by a prs provider and a scheme trustee in relation to private retirement schemes. Prs seek to enhance choices available for all malaysians whether employed or self employed to voluntarily supplement their retirement savings under a well structured and regulated environment. Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement.

How to choose the best private retirement scheme malaysia. How to choose the best prs malaysia to invest. Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement. The contents contained shall not be disseminated reproduced or used either in part or in.

Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment. Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment. Contribute to prs and enjoy. Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment.